Guar splits prices at 2 year lows, good monsoon, 50% tariff for exports to USA?!

Greetings from Mumbai! We are pleased to present you with our latest Guar Market Update.

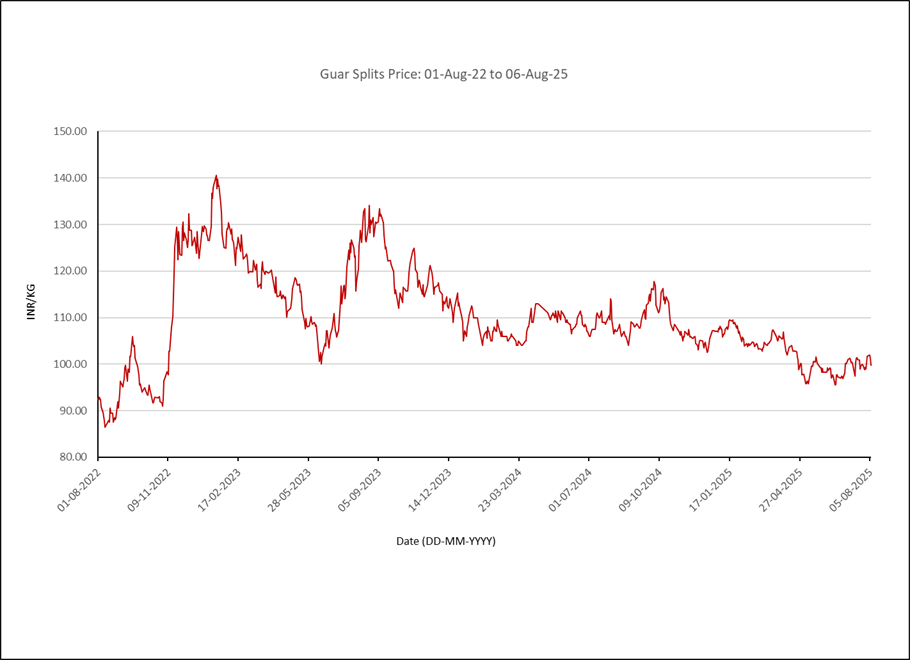

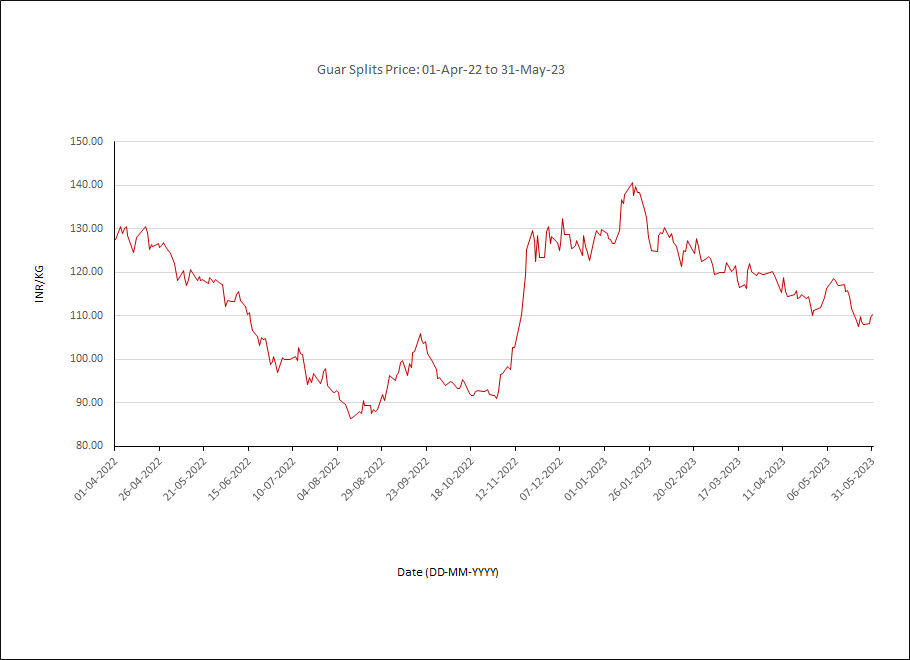

Guar Splits Price Trend

Please see the chart below for Guar Splits Prices (INR/kg) for the last 3 years.

- Prices peaked at around INR 140/kg in early 2023

- Now stabilizing at around INR 100/kg – a 2 year low!

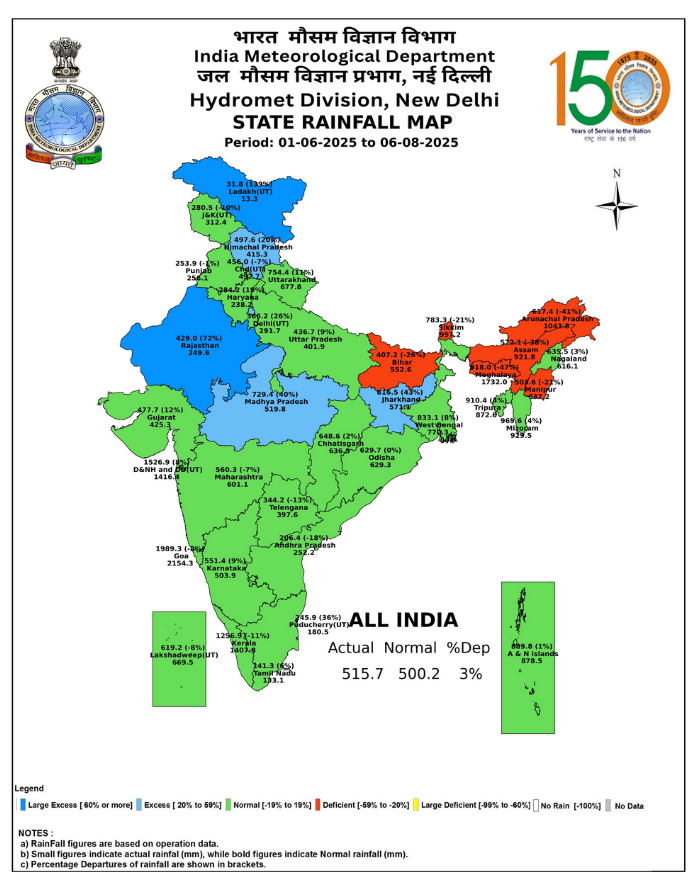

Progress of the 2025 Indian Southwest Monsoon and impact on the Guar crop

Please see the image below sourced from the India Meteorological Department’s website (https://mausam.imd.gov.in/)

- Some guar regions of Rajasthan have received excess to large excess rainfall

- While this has created excellent soil moisture for sowing and early growth, some localized crop damage is possible to the standing crop due to waterlogging in certain Guar growing areas of Rajasthan and Haryana

- As of now, a good crop is still expected overall

Guar Gum + Guar Splits: Export Trend (2023–2025)

As can be seen from the table below, if the trend for the first six months of 2025 continues, 2025 exports might reach a new record high. However, this must now be viewed cautiously in light of President Trump’s newly announced 50% tariff on Indian exports to U.S.A.

| Year | Guar Gum (MT) | Guar Splits (MT) | Total Exports (MT) |

| 2023 | 194,043 | 53,329 | 247,372 |

| 2024 | 247,315 | 80,299 | 327,614 |

| 2025 (H1) | 142,248 | 34,241 | 353,000 (projected) |

New Risk Factor – Tariff on Indian Exports

- President Trump, yesterday, imposed tariffs totalling 50% on Indian goods imported into U.S.A

- It is currently unclear whether this will be permanent, temporary, or negotiated lower

- If it remains at elevated levels, it could negatively impact Guar Gum exports to U.S.A. (the biggest market for Indian Guar Gum)

- Too early to quantify impact — but this adds a significant new uncertainty to the market outlook

Market Outlook Summary

| Factor | Current Status | Impact on Prices |

| Price Trend | Stable near 2-year low | Neutral |

| Monsoon | Good, with some damage risk | Maybe bearish |

| Export Demand | Consistent and as much as last year | Supportive |

| Inventory Levels | Likely good but lower carry over from previous years | Neutral |

| Tariff Risk | New & unclear | Potentially Bearish |

Recommendation

- Short-term buyers: Lock in current low prices

- Medium-term to long-term buyers: Begin phased procurement

- Tariff risk: Watch closely – if the tariff stays high, export demand (especially from the U.S. hydraulic fracturing industry) may drop, softening prices further

- Avoid over-contracting until tariff situation is clearer

Key Watchpoints

• Crop progress (Aug – Oct 2025)

• Export momentum (Q3 – Q4 2025)

• Evolution of tariff negotiations

• Global demand factors (especially from the U.S. hydraulic fracturing industry)

We trust you will find this report useful. Please let us know if you need any further information and/or clarifications